Minimum Income To File Taxes 2025. Minimum income requirements for filing a 2025 tax return. The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from.

The income up to $11,600 will be taxed at 10%, yielding $1,160; If you request an extension with the irs, you’ll have until oct.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, If you file on paper, you should receive your income tax package in the mail by this date. As of january 29, the irs is accepting and processing tax returns for 2025.

When Should You File A U.S. Federal Tax Return Aylett Grant, The agency expects more than 128. This is because the standard deduction.

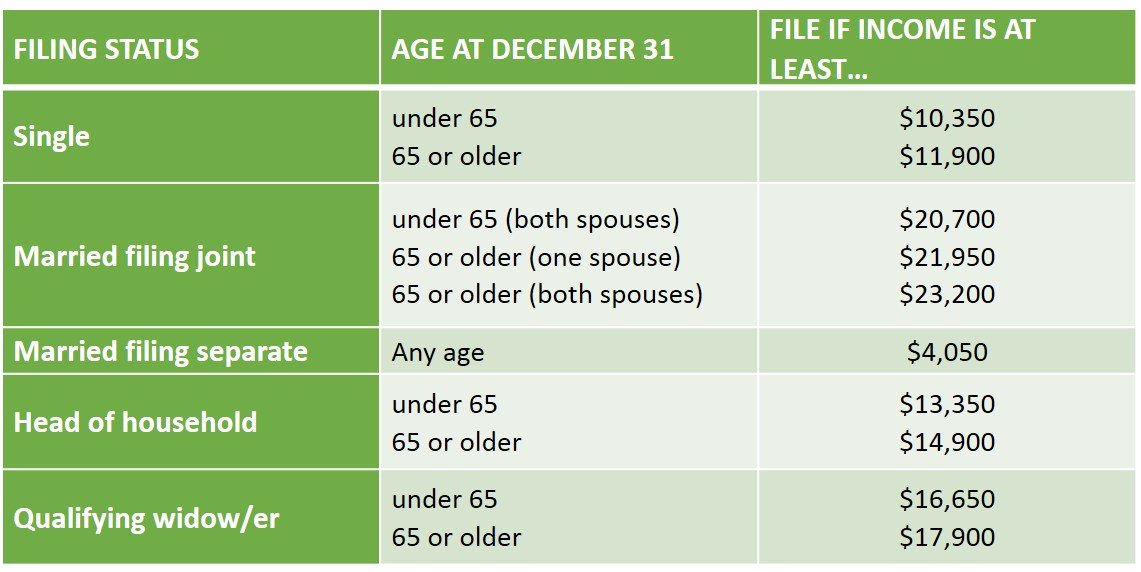

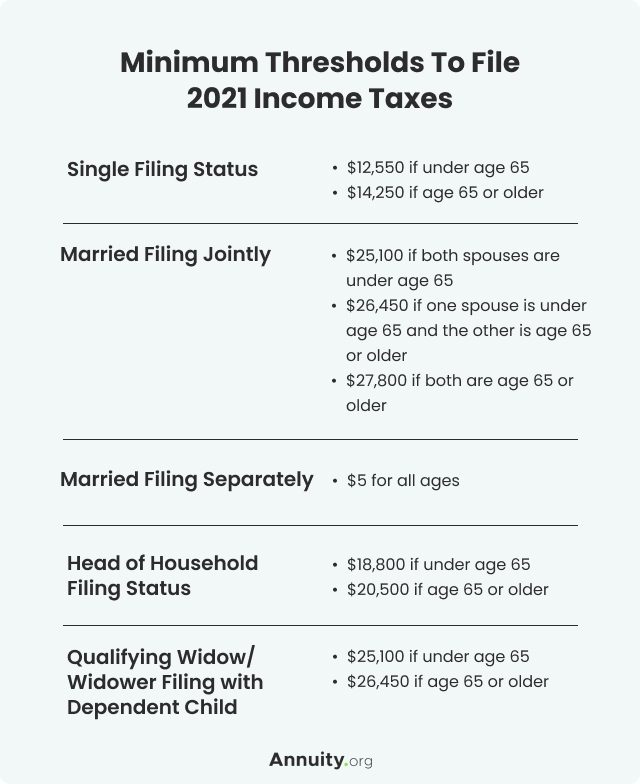

2025 Filing Taxes Guide Everything You Need To Know, Here's a breakdown of the minimum income requirements for various filing statuses: Your gross income is over the filing requirement.

Minimum to File Taxes 2025 2025, New tax brackets for 2025. The irs has a variety of information available on irs.gov to help taxpayers,.

Minimum to File Taxes 2025 2025, Not everybody pays the same amount of taxes. Taxpayers need to know their tax responsibilities, including if they're required to file a tax return.

Tax Checklist What Your Accountant Needs to File Your, Have to file a tax return. Not everybody pays the same amount of taxes.

Tax Return Who is requiredWhich FormDue datesFy 202223Ay, If your gross income was more than the larger of the following options: Only the maximum tax rate (“wealth tax.

.png)

Maximize Your Paycheck Understanding FICA Tax in 2025, New tax brackets for 2025. Here are the irs filing thresholds by filing status:

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, If you file taxes as an individual and have a combined income that exceeds $25,000, you’ll pay taxes on up to 85% of your social security benefit. The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain amount for the year. Citizens or permanent residents who work in the u.s.

The existing child tax credit is worth up to $2,000 for each qualifying dependent under 17, but it is reduced for married filers once their income exceeds.