2025 Tax Brackets Head Of Household Single. Tax brackets for people filing as single individuals for 2025. Knowing the tax brackets for 2025 can help you implement smart tax strategies, like adjusting your income tax withholding, so you don’t get caught with a.

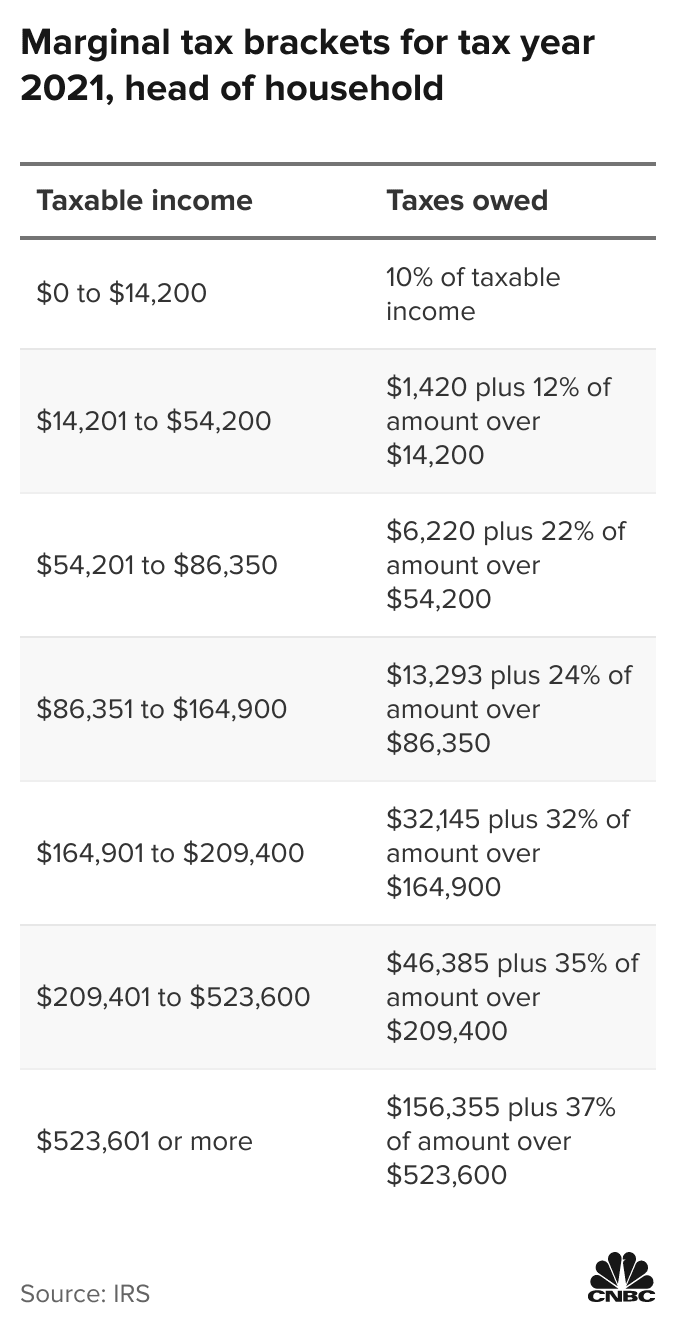

These brackets apply to federal income tax returns you would normally file in early 2025.) it’s. You pay tax as a percentage of your income in layers called tax brackets.

Irs Standard Deduction 2025 Head Of Household Mommy Therine, Knowing the tax brackets for 2025 can help you implement smart tax strategies, like adjusting your income tax withholding, so you don’t get caught with a.

Tax Brackets 2025 Single Head Of Household Lesli Noellyn, As your income goes up, the tax rate on the next layer of income.

2025 Tax Brackets Head Of Household Erica Blancha, As your income goes up, the tax rate on the next layer of income.

Tax Brackets For 2025 Head Of Household Single Caye Maxine, In fact, you may be able to tell if you’ll be in a higher tax bracket next year and make some financial.

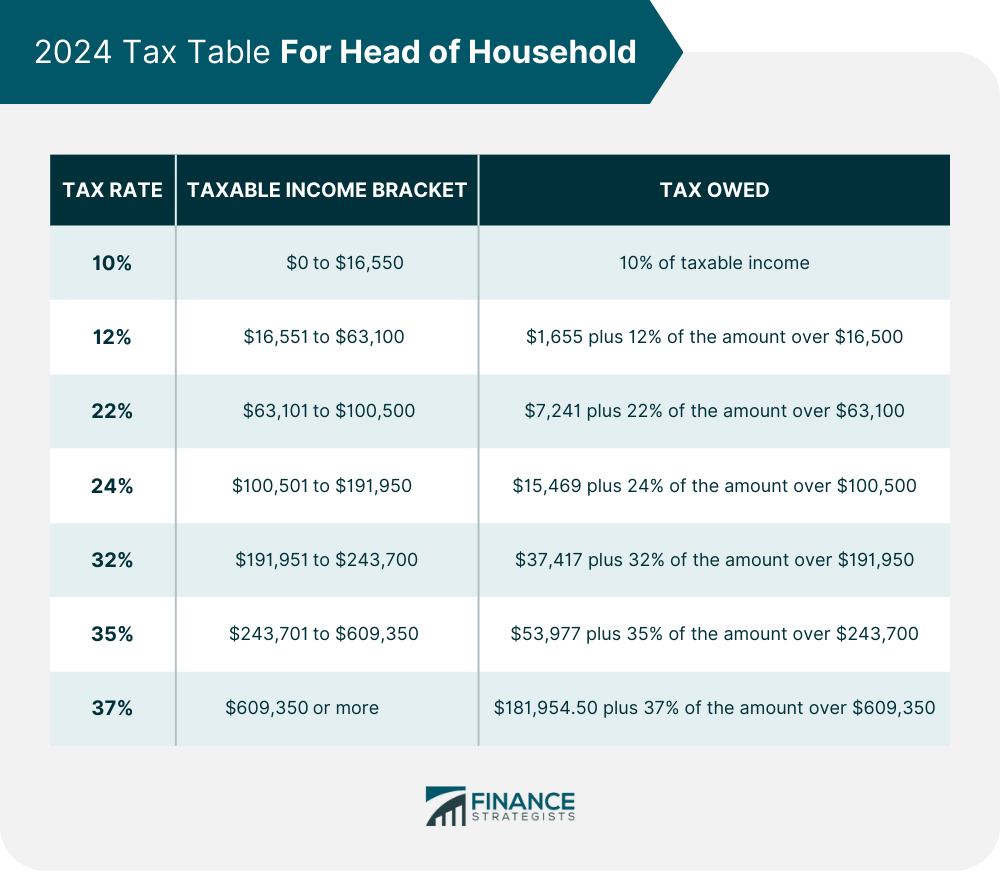

Tax Brackets For 2025 Head Of Household Leesa Nananne, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Tax Brackets 2025 Head Of Household Over 65 Nike Tawsha, Here's what taxpayers need to know.

Tax Brackets 2025 Head Of Household Single Denys Felisha, Your bracket depends on your taxable income and filing status.

2025 Tax Brackets Taxed Right, For example, married couples can choose to combine their incomes and potentially pay lower taxes by filing jointly.

Tax Bracket Chart 2025 Fern Orelie, Single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child.

Tax Rates Heemer Klein & Company, PLLC, Whether you're single, married filing jointly, or head of household, each status has its own set of tax brackets and benefits.